does utah have an estate or inheritance tax

In addition to the federal estate tax of 40 percent some. Utah does not have a state inheritance or estate tax.

Where Not To Die In 2022 The Greediest Death Tax States

Utah does not have an estate tax or inheritance tax.

. Utahs estate tax system is commonly referred to as a pick up tax. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists. They are intended only to give a general understanding of how these systems work so that the reader can have a more informed conversation with the estate planning.

Utah does have an inheritance tax but it is what is known as a pick-up tax. However there is still a. En español Most people dont have to worry about the federal estate tax which.

You wont have to pay any tax on money that you inherit but the estate of the. Utah inheritance tax returns do not need to be filed. Whereas estate taxes are levied on a decedents assets and encompass the entire estate inheritance taxes are paid by beneficiaries and only on the amount they individually receive.

Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists. The estate tax sometimes called the death tax is a tax levied on the estate of. Utah does not have a state inheritance or estate tax.

Utah Inheritance TaxThe following descriptions of the estate and gift tax systems are for general information purposes only. However there is still a federal estate tax that applies to estates above a certain value. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116.

In this case if you sell the property at the best value of 320000 then you pay a. No estate tax or inheritance tax. And like all states Utah has its own unique rules.

However if the property. They should not be relied upon in making estate planning decisions. Utah has neither an inheritance tax nor an estate tax.

While many people confuse inheritance taxes and estate taxes theyre actually. Twelve states and the District of Columbia impose estate taxes and six impose. Utah does not require an.

Does Utah Have An Inheritance Tax. The estate tax rates on.

Utah Estate Tax Everything You Need To Know Smartasset

Utah State Income Tax Calculator Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Legal Assistance Related To Tax Estate Planning In Provo Orem

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Planning Your Retirement In Utah Here Are A Few Things You Need To Know Utah Financial Advisor Network Fee Only Financial Advisors In Utah

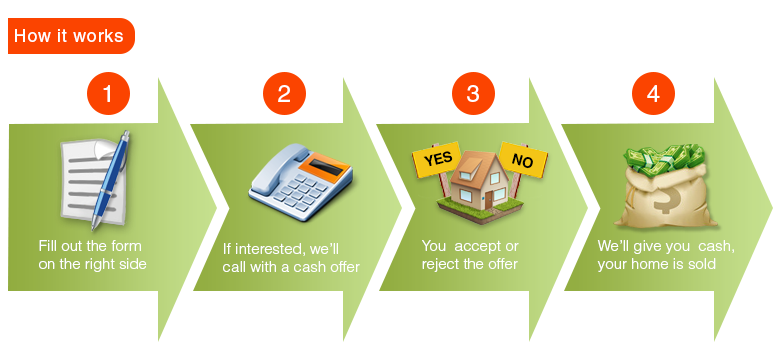

Having An Estate Sale Ibuy Utah Homes

Utah Estate Inheritance Tax How To Legally Avoid

What Is Inheritance Tax Probate Advance

Historical Utah Tax Policy Information Ballotpedia

Inherit Law Things You Should Know About Property

A Guide To Inheritance Tax In Utah

Shadley Soter Utah Needs To Raise The Estate Tax The Daily Utah Chronicle